student loan debt relief tax credit for tax year 2021

The Student Loan Debt Relief Tax Credit is a program. Ad The Comfort Of a Simple Debt Relief Is Priceless.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

The following documents are required to be included with your Student Loan Debt Relief Tax Credit Application.

. Pay Off Your Tax Bill with a PenFed Personal Loan. Thats a lot of debt. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details.

The male is the latest gatekeepers of relationship 2022年3月30日 Preciselywhat are cash advance in Kalamazoo MI. Suspended payments will appear as regularly rescheduled payments by credit-reporting agencies. About the Company Delaware Student Debt Relief Tax Credit.

About the Company 2021 Student Loan Debt Relief Tax Credit Maryland. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. The good news is that in some cases student loan balances can be forgiven or even paid off by an employer.

Is there relief for student loan debt during COVID-19. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. We are aware that student loan debt has become a growing concern among college graduates and wanted to remind you of a tax credit that you may be able to take advantage of.

According to the same source about 432 million student borrowers owe an average of slightly over 39000 each. Student Loan Debt Relief Tax Credit for Tax Year 2021. Student Loan Debt Relief Tax Credit for Tax Year 2021.

For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will get a 200 refund. About the Company Tax Relief For Student Loans. It was founded in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators.

Taxes are due April 18 this year and if you havent filed yet and are one of the 43 million Americans with student loan debt there are certain tax. CuraDebt is an organization that deals with debt relief in Hollywood Florida. It was established in 2000 and is an active participant in the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. CuraDebt is a debt relief company from Hollywood Florida. About the Company Student Loan Debt Relief Tax Credit Application 2021 Pdf.

This tax credit is given to help students offset some of. Complete the Student Loan Debt Relief Tax Credit application. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit.

If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference. Congress has previously passed some temporary fixes to student loan forgiveness taxation in recent years. A deduction is also available for the interest payments you make when you start repaying your loan.

Ad You Would Qualify for Income-Based Federal Benefits under the Obama Forgiveness Program. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions. Of that federal student loans total about 159 trillion.

As of 2021 the deduction is available to the following filers. Fillablechangeable documents such as Word or Excel are not acceptable. 2 days agoBiden Cancelled 15 Billion Of Student Debt For Borrowers But You Can Still Apply Now.

It was founded in 2000 and is an active part of the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators. Please submit all documents in PDF format. The TCDTRA extended the aforementioned favorable treatment for qualifying student loan debt payments made under employer Section 127 plans through 123125.

Enter the total level of tax credit up to 5000 being claimed based upon the total eligible undergraduate student loan debt balance. Having a tax refund offset on your student loans could result in less money than expected during tax season setting you back on your financial goals. Between 32820 and 123120 up to 5250 per-employee per year could have been paid out towards your student loan principal andor interest with no federal income tax hit for you.

Compare Rates Save Money. Individuals paying back federal student loan debt can defer payments and interest through May 1 2022 approved December 22 2021. The later Consolidated Appropriations Act 2021 CAA included the Taxpayer Certainty and Disaster Tax Relief Act TCDTRA.

There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. Updated for filing 2021 tax returns. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details 2022年3月30日 7 Women are the new gatekeepers away from sex. From July 1 2021 through September 15 2021.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. The student loan interest tax deduction. The Maryland Higher Education Commission MHEC is continuing their Student Loan Debt Relief Tax Credit for 2021.

Ad The Comfort Of a Simple Debt Relief Is Priceless. The tax benefits of your student loan dont end with the above credits. The Student Loan Debt Relief Tax Credit is a program created under 10.

September 15 2021. Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. When your student loans go into default there are several potential consequences ranging from an impact on your credit score to a tax refund offset on student loans.

Single filers with MAGIs of 85000 or less.

404 Page Not Found Magnifymoney Paying Student Loans Student Loan Forgiveness Paying Off Student Loans

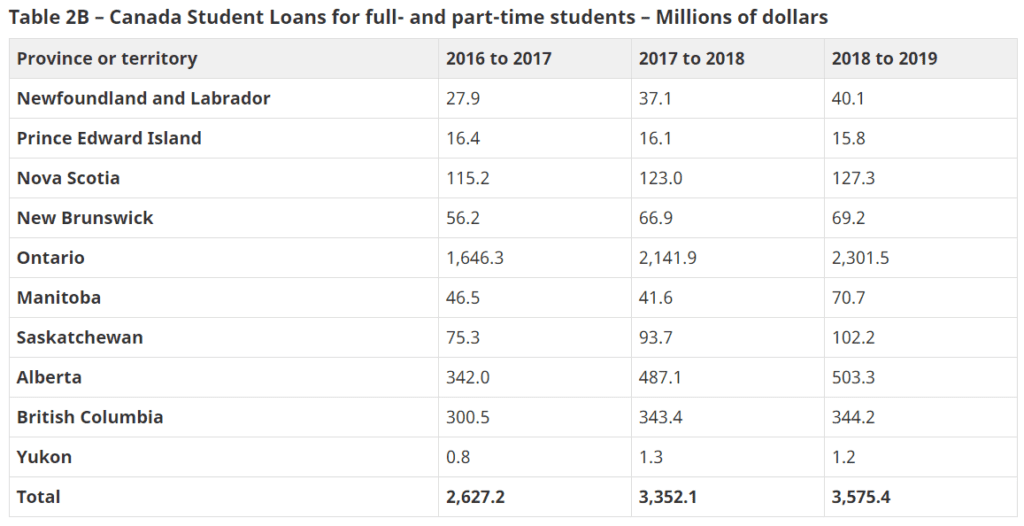

Student Loan Forgiveness In Canada Loans Canada

Student Loan Forgiveness Is Now Tax Free Nextadvisor With Time

William D Ford Act A Student Loan Scammer S Favorite Phrase In 2021 Student Debt Relief Scammers Student Loans

Find Relief With Student Loan Debt Consolidation Consolidated Credit Financial Literacy Student Loans Federal Student Loans

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Gross Vs Net Income Net Income Debt Relief Programs Credit Card Debt Relief

10 000 Or 50 000 Student Loan Forgiveness Could Biden Eliminate Debt Through Executive Order In 2021 Student Loan Forgiveness Student Loan Debt Forgiveness Debt Plan

Here S How To Get Student Loan Forgiveness Student Loan Forgiveness Graduate Student Loans Refinance Student Loans

Is Interest On Student Loan Debt Tax Deductible Consolidated Credit Ca

![]()

Student Loan Forgiveness In Canada Loans Canada

Awards National Debt Relief Tops On Independent Review Sites Debt Relief Programs National Debt Relief Debt Relief

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Loan Forgiveness In Canada Loans Canada

Student Loan Forgiveness In Canada Loans Canada

Here S What Happens If You Default On Your Student Loans Student Loans Refinance Student Loans Federal Student Loans

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Get Out Of Your Student Debt Faster Student Debt Student Loans Student Loan Debt

Facing Scrutiny Biden Administration Extends Student Loan Pause Until May Student Loans Student Loan Payment Student Debt Relief